This article has been revised and updated in accordance with the latest amendments to Andorran regulations.

Updated August 2023.

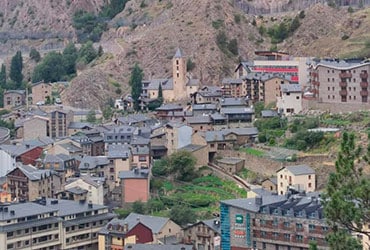

Andorra is a country of benefits and opportunities.

Besides the obvious economic, financial and fiscal perks, investing in Andorra offers several advantages, such as a quality of life that is among the best in the world. The country welcomes more than 8 million visitors each year, has a GDP per capita of over €39,068 a year, in 2022 (compared to €27,870 in Spain and €38,550 in France) and a minimum wage of €1286.13 per month (in 2023).

Andorra offers investors better terms than other EU countries.

In this article, we will explain the major advantages of investing in Andorra and how you can start your company in four easy steps.

- The maximum corporation tax in Andorra is 10%. Our country has one of the lowest corporate tax rates in the EU, particularly when compared to France which has one of the highest.

- Andorra has the lowest value added tax in Europe at 4.5%, by comparison the European average is 21.6%

- The annual fees corresponding to municipality, chamber of commerce, and governmental payments for maintaining your company do not exceed €800 for ordinary businesses.

- The social contributions made by companies are around 15.5%, much lower than the EU countries.

All of these benefits are highly attractive to foreign investors.

So what do I need to open my company in Andorra and begin trading?

If you are interested in creating a company in Andorra, the first thing to consider are the types of corporations that exist in our country.

Basically there are two types of corporation we can opt for:

- The S.L. or Societat Limitada(Private Limited Company) › This limited liability company can be incorporated with a minimum of €3,000 in capital

- The S.A. or Societat Anònima(Public Limited Company) › in this case, the minimum capital needed for incorporation is €60,000

Companies in Andorra must have a corporate address and an administrator. There is no offshore entity model (a type of corporation typically associated with tax havens, the distinguishing feature being that they are registered in a country in which they do not conduct any economic activity).

To incorporate a company, you just need to register the name that you intend to operate under, deposit the share capital with an Andorran bank and complete the incorporation through a public deed before a notary public.

The main steps you need to follow to open your company in Andorra are as follows:

First step

Reservation of a company name

You must submit the request to register a company name to the Government of Andorra. This process takes approximately two weeks.

You simply need to submit a form from the Trámits Department of the Government of Andorra, (*this link may have changed depending on the date on which you are reading this article) which must include 3 proposals for a company name, in addition to your contact and company information.

Second step

Foreign investment application

You must make a foreign investment application (*this link may have changed depending on the date on which you are reading this article) by completing the government form.

Third step

Opening a bank account

You must open a corporate account with an Andorran bank. You can consult the list of banks in Andorra.

Once the foreign investment authorisation has been approved and the bank account has been opened, the public deeds of incorporation can be granted before a notary public.

Fourth step

With regard to the registration of corporations, you must obtain the final incorporation through the notary public once you have the permits and an open account in which the required funds have been deposited. The notary public will be responsible for completing the registration in the company register.

You will have to register the company name with the council of the parish where you want to conduct your activity (this takes about a week) and open a trading establishment once the registration of the company name has been completed.

What must I do to open a trading establishment in Andorra?

You just need to register the company name you intend to operate under, have premises that are at least 20 m2, and request permission to open from the parish council.

For those who are self-employed and practice liberal professions, the opening of a trading establishment is optional.