Just like all other business sectors, 2022 will bring new innovations and trends for fintech. The last two years have been shaped by huge social changes as we adapt to the circumstances caused by the pandemic, and some of these changes are here to stay.

Of particular note are the growth of e-commerce and the rise of online payments; social distancing and the increased use of contactless payment methods in place of cash; and security, or rather cybersecurity, which is another factor that is becoming increasingly important for safeguarding user data.

These changes are prompting companies and organisations to seek out technological solutions to adapt their services to this new era. As a result, many of the technological innovations in the finance sector, which will soon come to light or begin development this year, are heading in this direction.

Contents:

- This year’s upcoming fintech trends

The increasing presence of blockchain

Simplified international payments

Digitalised asset management

Fintech cybersecurity

Big Data, artificial intelligence and 5G

Other fintech trends for this year

This year’s upcoming fintech trends

The term fintech is a portmanteau of the words finance and technology. It encompasses a range of projects in the realm of finance that apply technology and the digital environment to create innovative products and services which optimise financial processes, both for companies and users.

It is a relatively new industry that is always evolving and bringing new solutions to the market, so it is worth looking at where fintech trends are heading and which will be the most relevant this year.

The increasing presence of blockchain

This technology is generally associated with the world of cryptocurrencies. However, in recent times, it has become increasingly relevant for the development of innovative financial and business solutions. It will feature prominently in the implementation of secure data protection systems, the creation of digital identities and the streamlining of transactions and operations that will become increasingly secure and reliable for users.

Banking is likewise another sector that has taken an interest in this technology, and is expected to invest in implementing blockchain solutions in its services in 2022.

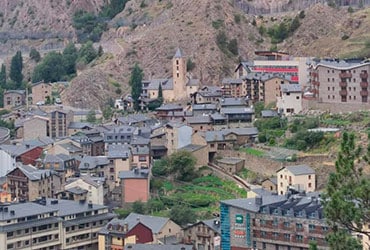

Andorra is currently preparing a blockchain law, for more information you can read our article Blockchain in Andorra: increasingly close to regulatory law

Simplified international payments

The growth of e-commerce, along with investment and stock market trading, has led to a surge in cross-border payments. However, since each region works with different data and laws, these transactions are complicated, time-consuming and expensive. With this in mind, the G20 has presented a roadmap, which involves central banks, for developing systems to enhance cross-border payment processes. The blockchain will also play a key role in enabling real-time transactions between sender and receiver, thereby avoiding bank transfers that take longer to process.

2022 will be a key year for the simplification of international payments.

Digitalised asset management

Another fintech trend can be found in the wealthtech sector as it applies to asset management. Like fintech, wealthtech is a portmanteau of the words wealth and technology.

It is also expected to grow this year by offering financial services such as robo-advice, digital stockbrokers, automated trading platforms, along with new investment tools and NFTs (non-fungible tokens). Wealthtech has been able to take advantage of the traditional banking vacuum to create tools geared towards personal finance as well as asset management and advisory platforms.

Fintech cybersecurity

When it comes to personal data and monetary transactions, security is a key factor that cannot be ignored. Large investments are expected in cybersecurity and RegTech (technology applied to the regulatory framework). Companies in this sector improve the implementation of cybersecurity and data protection technology to prevent fraud and money laundering. Fintechs use these tools for identity verification and data protection purposes, enabling more agile customer management.

Big Data, artificial intelligence and 5G

Events and applications related to big data and artificial intelligence were also affected by the pandemic. As a result, new projects based on these technologies will emerge this year in the fintech sector.

The rollout of 5G has likewise been delayed. Its implementation will improve connectivity and boost data transmission in a way that will support the use of new platforms and applications in general, and particularly in the financial sector.

Other fintech trends for this year

The growth of digital banking

We will see a rise in branchless banks. Banking transactions and operations are increasingly carried out via the internet or mobile apps, which is already driving the emergence of new banks without brick-and-mortar premises.

The shift towards voice payments

The next step in contactless payments is simple voice-activated banking transactions, such as sending payments, claiming payments or consulting financial products.

The rise of digital wallets

Another fintech trend associated with payments is the ability to have your digital wallet accessible on any device with a screen, like a smartwatch or a TV, not just your phone.

Crowdfunding equity will grow

Companies and startups will find new investment channels through crowdfunding via equity platforms.

Progress towards disintermediation

Disintermediation platforms are also set to grow in the financial sector, particularly with regard to making online payments or using digital signatures, and everything will be available from smartphones.

Which of these fintech trends surprised you the most?

Are you aware of any others we haven’t mentioned that could revolutionise finance?

At Advantia Assessors, we like to stay on top of the latest innovations in the sector so we can share them with you.